The debt of developing countries

|

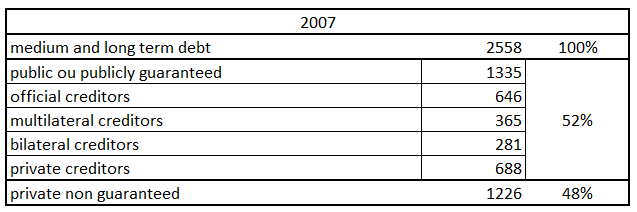

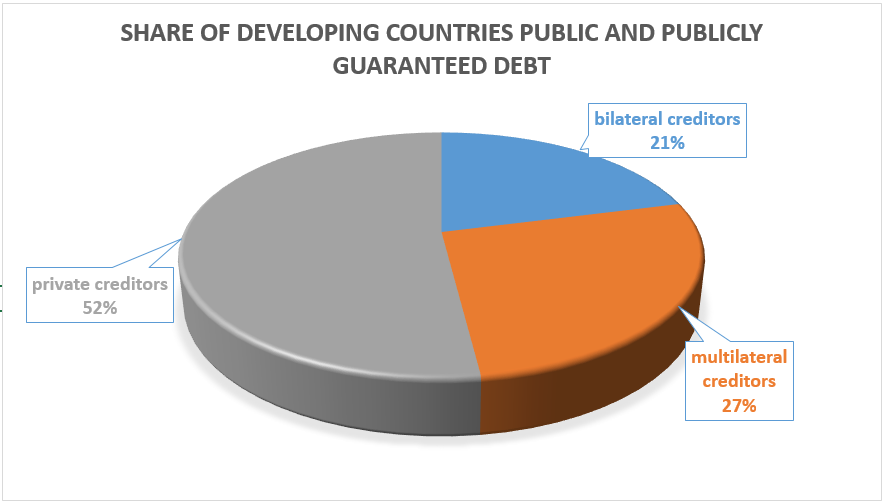

External debt is a source of financing for developing countries Developing countries and countries in transition can raise funds from the international financial community and finance their development through a number of instruments, including attracting equity (notably foreign direct investment), receiving grants from donors, or borrowing from foreign lenders. According to the Word Bank, net flows of capital received by developing and emerging countries in 2007 reached $370 billion in the form of foreign direct investments, $140 billion in equity flows, $166 billion in new lending and $75 billion in grants. Among these four instruments, debt results directly in future obligations for the borrower (debt must be repaid). This makes it necessary for the borrower to make sure that it will, in the future, be in a position to repay its debt, notably through an efficient use of the loans, in order to generate income that will be used to repay the debt. This is why debt is often considered as a development tool. However, for the poorest and most indebted countries, the accumulated debt burden has become a drawback for development; this is why the international financial community designed the Heavily Indebted Poor Countries (HIPC) Initiative, and most Paris Club member governments decided to provide financing to these countries mostly through grants. The external debt of developing countries comprises several types of debts Each organisation compiling and publishing debt figures may have different ways to categorize and to measure debt. The debt owed by a country can be broken down into a number of different types (see types of debt for further details): by debtor (which may be a sovereign government, a public company or a private debtor), or by creditor (which may be a multilateral creditor, a government, a private creditor). Over time, the share of private debt (debt owed by private debtors) and the share of private claims (debt owed to private creditors) have increased, reflecting the increased role of the private sector in both industrialised and developing countries. As of 31 December 2007, the total debt of developing and emerging countries was estimated by the World Bank to be $3,357 billion, out of which $2,558 billion of medium- and long-term debt, broken down as follows:

According to the World Bank, the total amount of the medium- and long-term debt of developing countries has increased over the past ten years. Creditworthiness varies significantly from country to country The creditworthiness of a country is the assessment by potential lenders of the country's capacity to repay its external debt. Being creditworthy is a key to success for developing countries because they can borrow larger amounts to finance growth and development. In addition, a creditworthy debtor is in a position to borrow funds used to refinance its existing debt obligations Governments of debtor countries have a significant impact on the creditworthiness of all borrowers of developing countries, since a government default can have consequences for the capacity of other borrowers to repay their debt. A number of factors influence creditworthiness. Some are linked to economic factors, such as the capacity of the country to generate balance-of-payment receipts, and the volatility of these receipts. Others are financial factors, such as the debt repayment profile. Political factors also play a role in the creditworthiness of a debtor country, when its government considers the cost of paying debt to be too high. Creditworthiness usually takes a long time to build, as lenders tend to assess over time the capacity of the debtor to repay its debt before entering into large lending. In contrast, failure to fulfil debt obligations can rapidly damage creditworthiness. Under circumstances where debt restructuring cannot be avoided, countries that do not accumulate arrears and take preventive steps to reach a coordinated solution with their creditors, notably in the Paris Club, can restore their creditworthiness more rapidly afterwards. In contrast, debtors that declare a unilateral moratorium tend to lose access to new financing for some time. |